lincoln ne sales tax rate 2018

That money has been used to buy and install a new 911 radio. The Lincoln sales tax rate is.

General Fund Receipts Nebraska Department Of Revenue

For tax rates in other cities see Nebraska sales taxes by city and county.

. L Local Sales Tax Rate. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Lincoln NE Sales Tax Rate.

Income Tax Rate Indonesia. S Nebraska State Sales Tax Rate 55 c County Sales Tax Rate. Replacement of the Citys emergency 911 radio system and the construction andor relocation of four.

Lancaster county 201415 201718 201819 201920 1 yr 5 yr tax rates for taxpayers rate rate rate rate change change inside lincoln city limits agric. Lincoln has a 5 sales tax rate or 25 for most businesses. Notification to Permitholders of Changes in Local Sales and Use Tax Rates.

County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted By 5-Digit Zip. Lincoln is located within Lancaster County Nebraska. The Lincoln County sales tax rate is.

This rate includes any state county city and local sales taxes. Within Lincoln there are around 28 zip codes with the most populous zip code being 68516. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

Current Local Sales and Use Tax Rates and Other Sales and Use Tax. Table of Sales Tax Rates for Exemption for the period July 2013 June 30. The state sales tax rate stands at 55 percent or around five and a half cents for ever dollar spent.

This is the total of state and county sales tax rates. The Nebraska state sales and use tax rate is 55 055. Sr Special Sales Tax Rate.

The Lincoln sales tax rate is 175. In Lincoln another 15 percent or one and a. To review the rules in Nebraska visit our state-by-state guide.

Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Manufactured and. Restaurants In Matthews Nc That Deliver. Lincoln in Nebraska has a tax rate of 725 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Lincoln totaling 175.

Troy MO 63379 Email Me. Has impacted many state nexus laws and sales tax collection requirements. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

Sales Tax Rate s c l sr. The Nebraska state sales tax rate is currently. This table shows the total sales tax rates for all cities and towns in Lincoln County including all local taxes.

Lincoln NE Sales Tax Rate. Lincoln County NE currently has 1041 tax liens available as of February 24. In 2015 voters approved a three-year quarter-cent sales tax that ended in September 2018.

You can print a 725 sales tax table here. Society of lancaster co. The 2018 United States Supreme Court decision in South Dakota v.

Did South Dakota v. The County sales tax rate is 0. 2020 rates included for use while preparing your income tax deduction.

As far as sales tax goes the zip code with the. Revenue Information Bulletin 18-017. 025 lower than the maximum sales tax in NE.

La Vista NE Sales Tax Rate. The latest sales tax rate for Liberty NE. Nebraska has a 55 sales tax and Lincoln County collects an additional NA so the minimum sales tax rate in Lincoln County is 55 not including any city or special district taxes.

The Nebraska state sales and use tax rate is 55 055. The Nebraska sales tax rate is currently 55. Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton.

There is no applicable county tax or special tax. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. Hours Monday - Friday 8 am.

Lincoln Ne Sales Tax Rate 2018. Lincoln voters approved the 14-cent increase in April to support two important public safety projects. Lexington NE Sales Tax Rate.

McCook NE Sales Tax. The December 2020 total local sales tax rate was also 6000. You can print a 725 sales tax table here.

Notification of Change of Sales Tax Rate for Remote Dealers and Consumer Use Tax. The average cumulative sales tax rate in Lincoln Nebraska is 688. This is the total of state county and city sales tax rates.

NE Sales Tax Rate. One of a suite of free online calculators provided by the team at iCalculator. Groceries are exempt from the Nebraska sales tax.

So whilst the Sales Tax Rate in Nebraska is 55 you can actually pay anywhere between 55 and 75 depending on the local sales tax rate applied in the municipality. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018. Revenue Information Bulletin 18-019.

The 8 sales tax rate in Lincoln consists of 65 Washington state. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75. Ad Get Nebraska Tax Rate By Zip.

The 2018 United States Supreme Court decision in South Dakota v. Opry Mills Breakfast Restaurants. Delivery Spanish Fork Restaurants.

Free Unlimited Searches Try Now. This includes the sales tax rates on the state county city and special levels. Essex Ct Pizza Restaurants.

Lincoln NE Sales Tax Rate. 0001516 0001409 0001391 0001347-316 -1115 airport authority 0000000 0000000 0000000 0000000 na na city of lincoln 0319580 0316480 0316480 0319800 105 007. Soldier For Life Fort Campbell.

How To Register For A Sales Tax Permit Taxjar

1239 Silver Ridge Rd Lincoln Ne 68510 Realtor Com

Sales Tax Rates In Major Cities Tax Data Tax Foundation

General Fund Receipts Nebraska Department Of Revenue

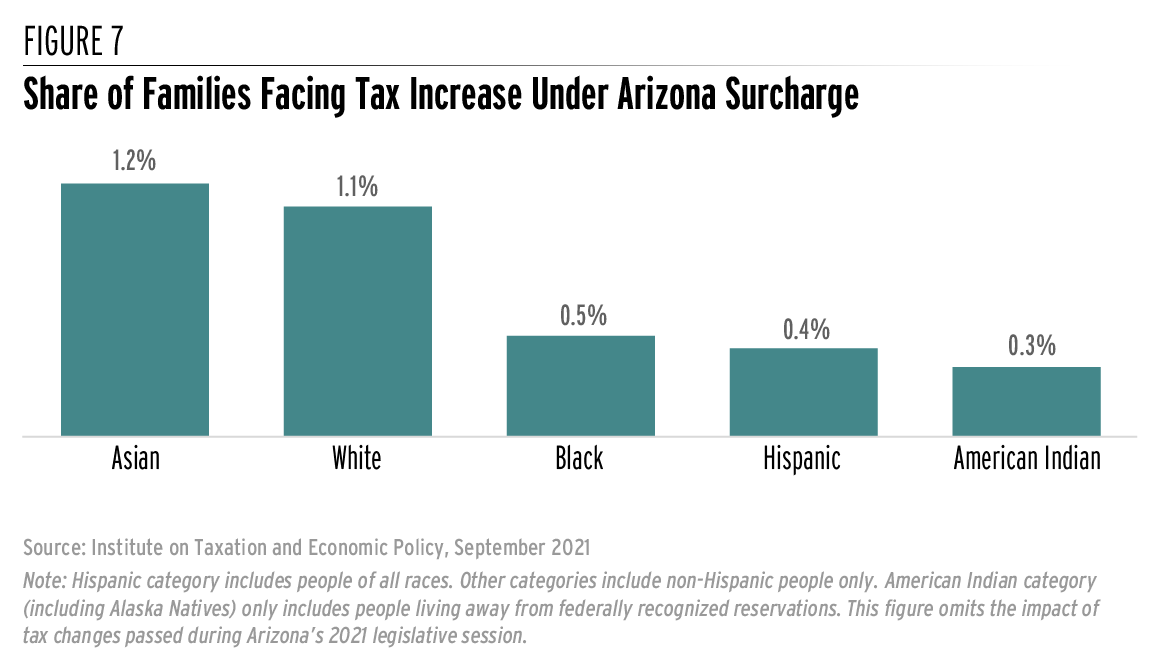

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

9515 Koi Rock Dr Lincoln Ne 68526 Realtor Com